Stralliance's performance, unique systematic methodologies.

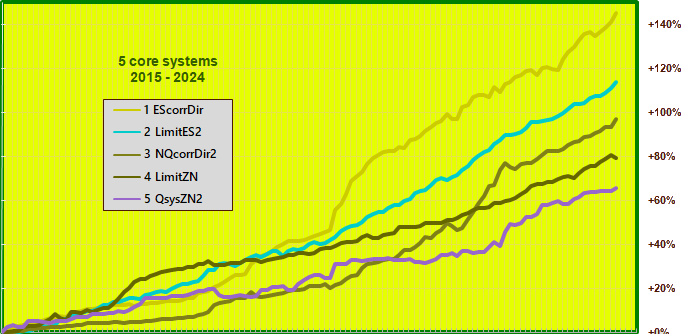

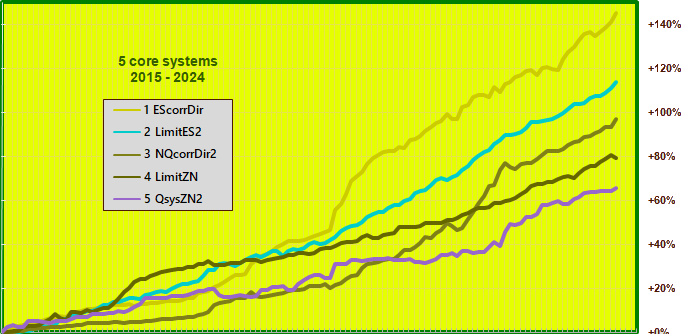

- Stralliance boasts an outstanding performance record, encompassing a blend of theoretical and actual trade data spanning from 2015 to 2024, followed by full trading operations from 2nd January 2025.

Our robust risk-adjusted performance is driven by four distinct non-correlated core strategies, each generating average annual returns of 8% to 19%. While these 4 core strategies' cumulative profits add up, their loss periods do not overlap, resulting in relatively low composite drawdowns and excellent risk-adjusted returns.

Stralliance's theoretical performance over the last 12 years:

63% pa CAGR;

164% pa with 2x leverage;

Worst historical daily cumulative DrawDown: 3.5% DD;

(S&P 500 during the same period: 33.9% DD);

Profit to risk ratio: 16.9 (S&P 500: 0.3);

MAR ratio: 17.9 (S&P 500: 0.3);

Yearly Sharpe ratio: 1.9 (S&P 500: 0.7);

Average 11 profitable months per year;

Outperforms the S&P 500 nine out of 12 months on avg;

79% historical trade win rate;

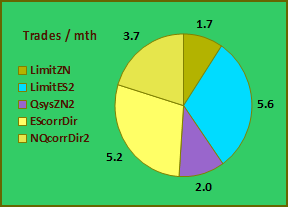

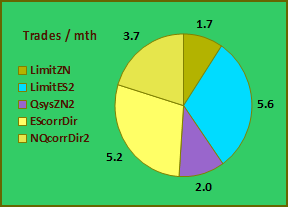

Average 16 daily trades per month.

- We are Long/Short market-neutral; our returns are not dependent on market trends.

Stralliance's performance has practically no correlation to any major index.

Monthly correlations (+100% to -100%): S&P 500 index +19%, Funds index +9%, CTA index -2%.

- We trade two of the world's most liquid futures contracts:

eMini S&P 500 (ES) and eMini NASDAQ (NQ).

Liquidity is never an issue, so capital gates (investor redemption halts) are not required.

- Our trades are open from a few minutes up to a max 23 hours for each market session. We have no exposure to any long-term or holiday geopolitical risk.

- Our safety target mandates a maximum 10% risk, measured by daily cumulative drawdowns (DD). By comparison, the S&P 500 Index has had a 34% DD since Jan 2015. Our current maximum drawdown is significantly below this 10% threshold. Ensuring capital safety remains our paramount objective.

- Performance target: 40%+ pa net returns, currently safely exceeding our target. Consistent returns is our major priority. Stralliance's risk-adjusted performance far exceeds that of any benchmarks or top-performing funds.

- Stralliance trades a basket of four core systems with little or no leverage, averaging a combined total of 16 trades per month:

1 volatility-capture, 3 market-directional, NeuralNet-based 100% systematic methodologies.

All four core systems adapt to changing market conditions in (almost) real-time.

All strategies, as well as our 10-stage risk management, are fully systematic.

Our four core systems compliment each other well. There is a low correlation between core systems' performance, hence the relatively low volatility and smooth returns.

- Stralliance's proprietary multi-layered Recurrent Neural Networks (RNNs), developed and refined over the past 14 years, have been specifically designed to mitigate over-fitting.

Over-fitting, also known as curve-fitting, is a prevalent practice wherein systems are developed and backtests are optimized to fit past performance. This often leads to inflated performance metrics that are unsustainable and unlikely to persist in the future.

We live in exponential times. Markets are evolving at an accelerating pace. Standing still is not an option.

- The landscape of financial markets is continually disrupted by emerging technologies such as sub-millisecond HFT algorithms, instantaneous news-scraping AI bots, and increasingly sophisticated neural networks.

Coupled with a pervasive shift towards shorter-term trading, these factors contribute to rapidly evolving market dynamics over shorter timeframes.

Trading strategies that were once profitable, even just a few years or months ago, quickly lose their effectiveness and edge in today's dynamic markets. To stay ahead in this environment, modern trading methodologies must be not only fully systematic but also capable of self-adapting to swiftly-changing market conditions.

- Stralliance's continually-evolving AI-based methodologies are 100% systematic.

Originating in 2010 as a more efficient method for backtesting complex trading systems, Stralliance's backpropagation innovation swiftly evolved into the concept of weighted matrices, pivotal components underlying the architecture of modern neural networks.

Our trading methodologies are based on proprietary Recurrent Neural Networks (RNNs) finding hidden profitable patterns in these ever-shifting markets.

Our edge comes from the correct application of RNNs, a balanced portfolio of complementary strategies, and the understanding and mitigation of every system's development curse: over-fitting.

We aim to maintain our profitable edge in ever-changing market patterns, and take advantage of new opportunities as they emerge in highly-liquid markets.

As emerging market patterns overtake and outperform older ones, new methodologies are being continually researched, developed, monitored, reviewed and implemented through our R&D pipeline process. Our evolutionary Research & Development process never stops.

- We actively manage capital risk exposure through systematic position sizing. Our comprehensive 10-layer Risk Management procedures are seamlessly integrated into our strategies to ensure consistent returns.

Contract lot sizing is dynamically adjusted in real-time through precise systematic position management for each trade, contributing to relatively predictable and smoother returns.

- Stralliance operates in a Long/Short market-neutral environment. We remain impartial towards future predictions and refrain from making financial market forecasts. Instead, we assess short-term profit probabilities by analyzing a blend of intricate interdependent factors.

Our methodologies are devoid of reliance on predictive models, focusing instead on a probabilistic evaluation of current market dynamics.

We apply systematic situational analysis complemented by adept integration of probabilities, to make informed decisions which typically yield favorable outcomes over the long run.

Amidst a plethora of competing hedge funds, Stralliance stands out as an 'edge' fund, uniquely positioned to capitalize on market opportunities.

- Stralliance's cutting-edge methodologies and proprietary neural networks are the culmination of Jose Silva's unwavering drive and passion for financial engineering:

- Approx 42,000 man-hours ($12 million just in programming fees) full-time R&D and programming since early 2010;

- More than 25 years' experience in the markets, and over 85,000 man-hours designing & building unique R&D financial tools since 1999.

© 2015-2026 Stralliance Capital Management

Past performance is not necessarily indicative of future results. The risk of loss in all types of trading can be substantial.

The presentation of information and data provided do not constitute a solicitation for investment funds, nor an offer to transact in any commodity interest or any other related financial product(s).